insurance fund

Providing protection for customers

Check Total Fund Assets

With ZKE, you can trade with confidence because we take asset security very seriously.

Below are the insurance fund benefits coverage available for transactions using our platform:

Rules for users to share insurance funds:

Details of the insurance fund share, rules for sharing amounts and screening of profitable positions.

Rules of the amount of the share:

流水记录:

Proportion of losses borne by the Insurance Fund:

The insurance fund will cover a percentage of your loss when the system penetrates the position.

Percentage of loss to be borne:

20% by the insurance fund

80% shared by users' profitable positions

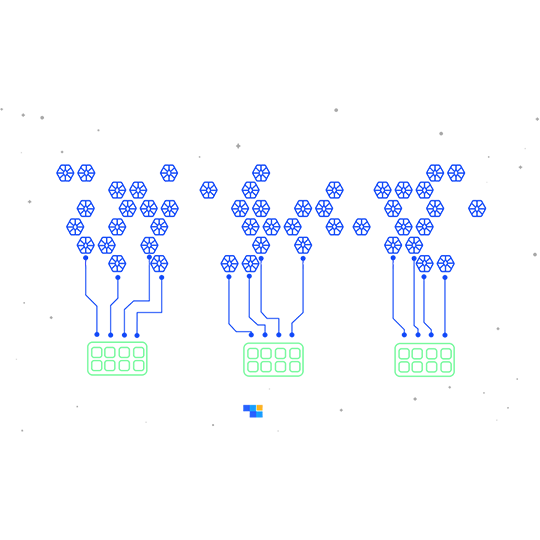

Apportionment of Profit Positions:

Screening rules for profitable positions.

Rule on the amount to be apportioned.

Frequently Asked Questions

Answers to your insurance fund questions

What is an insurance fund?

+Insurance fund is a fund that compensates for losses due to "margin call liquidation" of a user's position in extreme market conditions, in order to reduce the possibility of user contribution. In our exchange contracts, all currencies and perpetual contracts with the same margin share the same insurance fund.

How is the insurance fund created?

+After the "Forced liquidation" engine takes over the position, the profit from processing the position will be injected into the insurance fund. In case of "Forced liquidation", the "Forced liquidation" engine takes over the user's position and the remaining margin at the takeover price. If the "Forced liquidation" engine "closes the position" at a price better than the takeover price, it generates a profit, which will be fully credited to the insurance fund.

How is the insurance fund used?

+In case of "Forced liquidation", the "Forced liquidation" engine takes over the user's position and the remaining margin at the takeover price. If the position continues to lose money, if the engine of "Forced liquidation" loses money after "closing position", this loss is considered to be the loss of the system "margin call liquidation". A part of the "margin call liquidation" loss will be compensated by the insurance fund and the rest will be shared by the user.